irs child tax credit customer service

The Internal Revenue Service erroneously sent more than 1 billion in child tax credit payments last year to millions of Americans who werent eligible for the free cash an. Choose the location nearest to you and select Make Appointment.

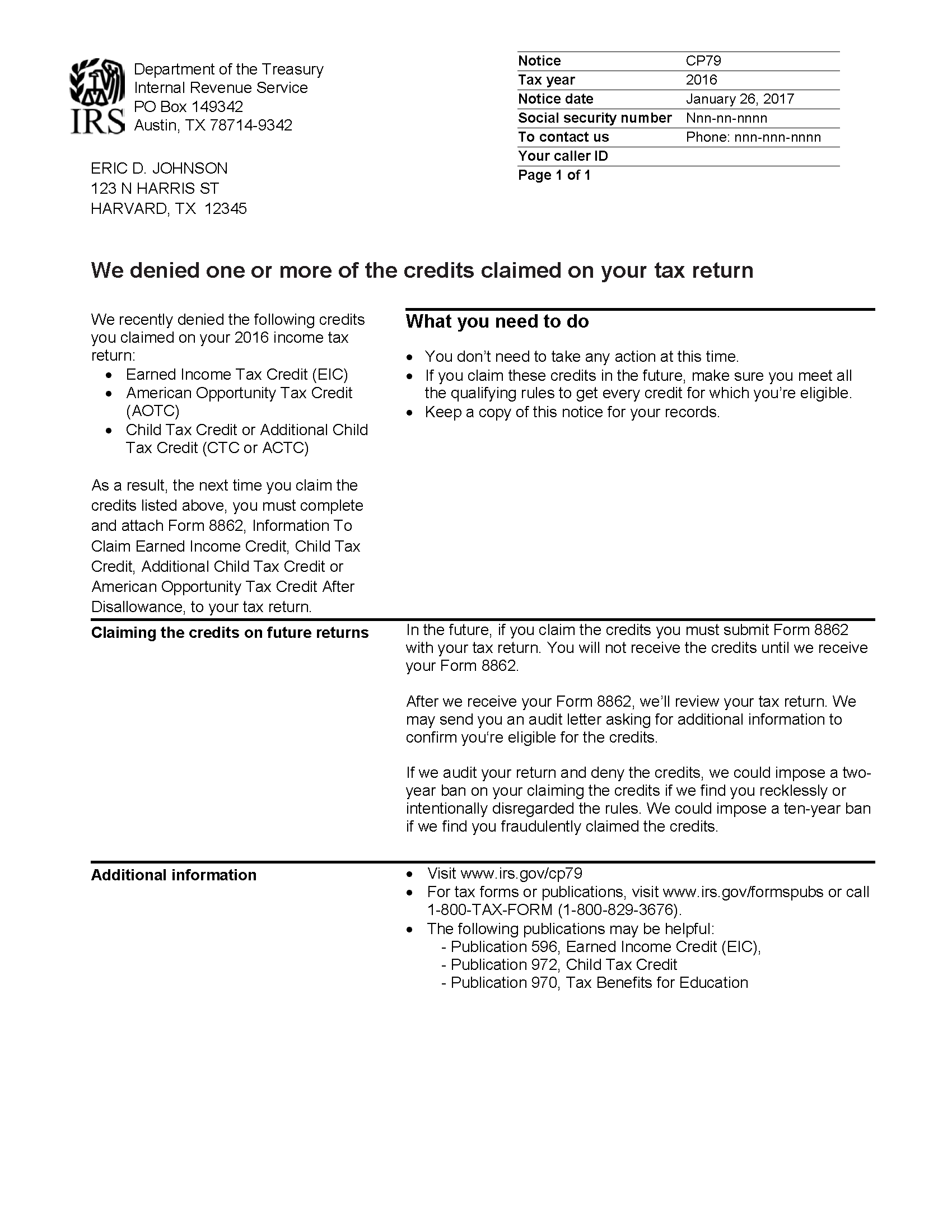

Irs Notice Cp79 We Denied One Or More Credits Claimed On Your Tax Return H R Block

It is a tax law resource that takes you through a series of questions and provides you with responses.

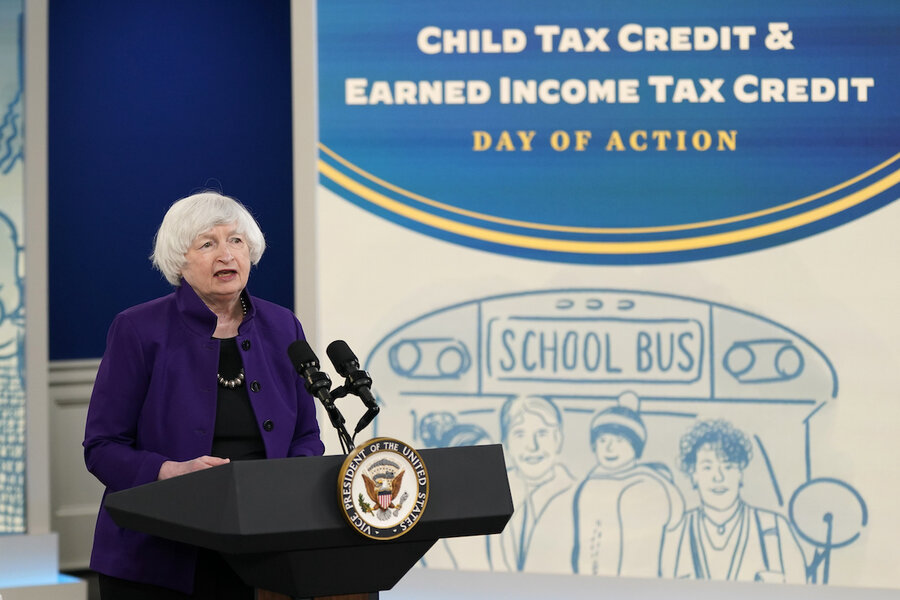

. To get started you can call 800-829-1040 to reach the tax agency about an issue youre having with your child tax credit payment. Former IRS Commissioner John Koskinen said a challenge for the agency and the child and earned income tax credit programs is to actually get read more. Have been a US.

For more details see Topic H. Child Tax Credit for 2022. IRS sent over 1 billion in child tax credit payments to.

Irs child tax credit customer service Thursday June 30 2022 Edit. Frequently Asked Question Subcategories for Childcare Credit Other Credits. Learn more about this topic.

Try one of these numbers if any of them makes sense for your. Many families received advance payments of the Child Tax Credit in 2021. IRS Child Tax Credit Services.

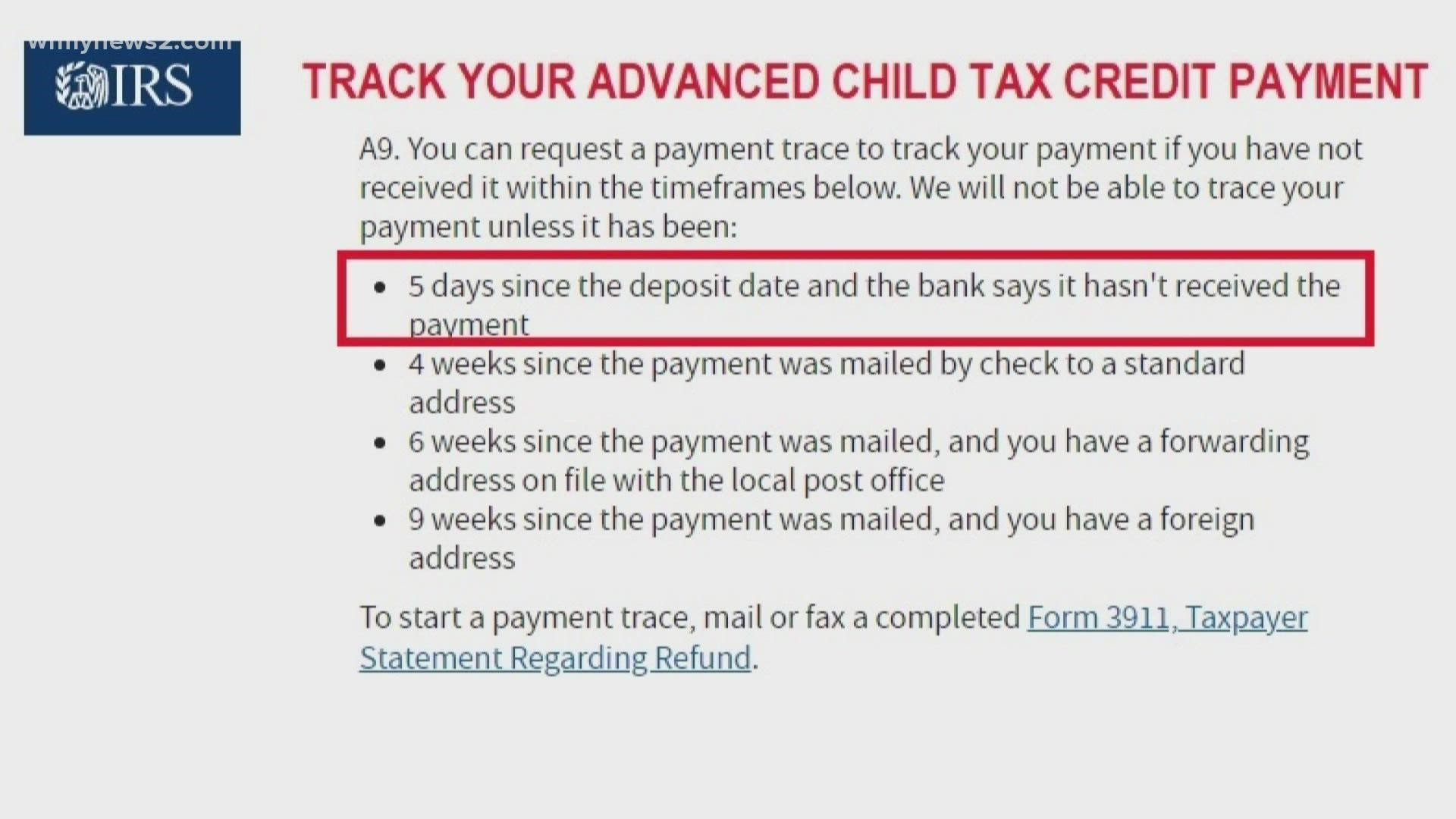

The advance payments of the Child Tax Credit are well underway with the third payment to be deposited Sept. You can no longer view or manage your advance Child Tax Credit Payments sent to you in 2021. You can see your advance payments total in.

Head to the IRS Taxpayer Assistance Tool page and enter your ZIP code. Many families received advance payments of the Child Tax Credit in 2021. 52 rows IRS Phone Number.

These updated FAQs were released to the public in Fact Sheet 2022-32PDF July 14 2022. Make sure you have the following. 15 but the millions of payments the IRS has sent out have not.

Estate and gift tax questions. This one-pager lists locations and addresses of IRS Tax Assistance Centers TAC nationwide where the IRS will host AdvCTC Child Tax Credit Free. Use our contact form to.

The paltry figure for customer service seems to fly in the face of a vow made by one Treasury Department official. For all other tax law inquiries visit the Interactive Tax Assistant on irsgov. Customer Service and Human Help Options.

Back to Frequently Asked Questions. The IRS maintains a range of other phone numbers for departments and services that deal with specific issues. Yes you may claim the child tax credit CTCadditional child tax credit ACTCrefundable child tax credit RCTCnonrefundable.

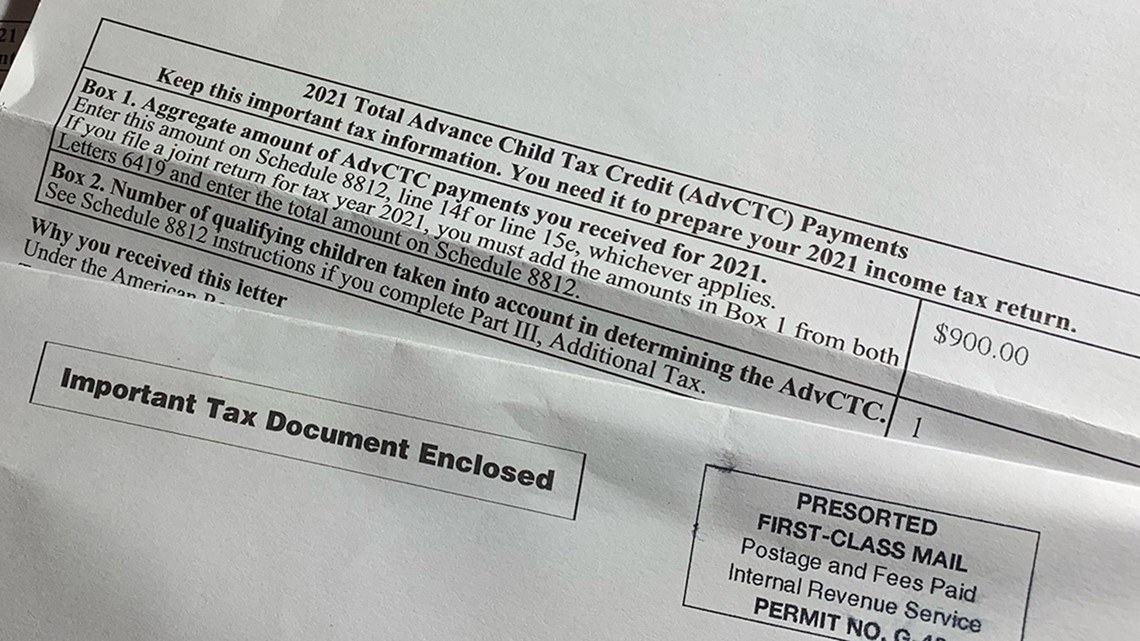

If you received advance payments of the Child Tax Credit you need to reconcile compare the total you received with the amount youre eligible to claim. Find answers about advance payments of the 2021 Child Tax Credit. The advance payments of the Child Tax Credit are well underway with the third payment to be deposited Sept.

Missing child tax credit payments. 15 but the millions of payments the IRS has sent out have not. The Child Tax Credit Update Portal is no longer available.

The child tax credit is. Reconciling your Advance Child Tax Credit Payments on your 2021 Tax Return on the IRS website. Child and Dependent Care Credit Flexible Benefit Plans.

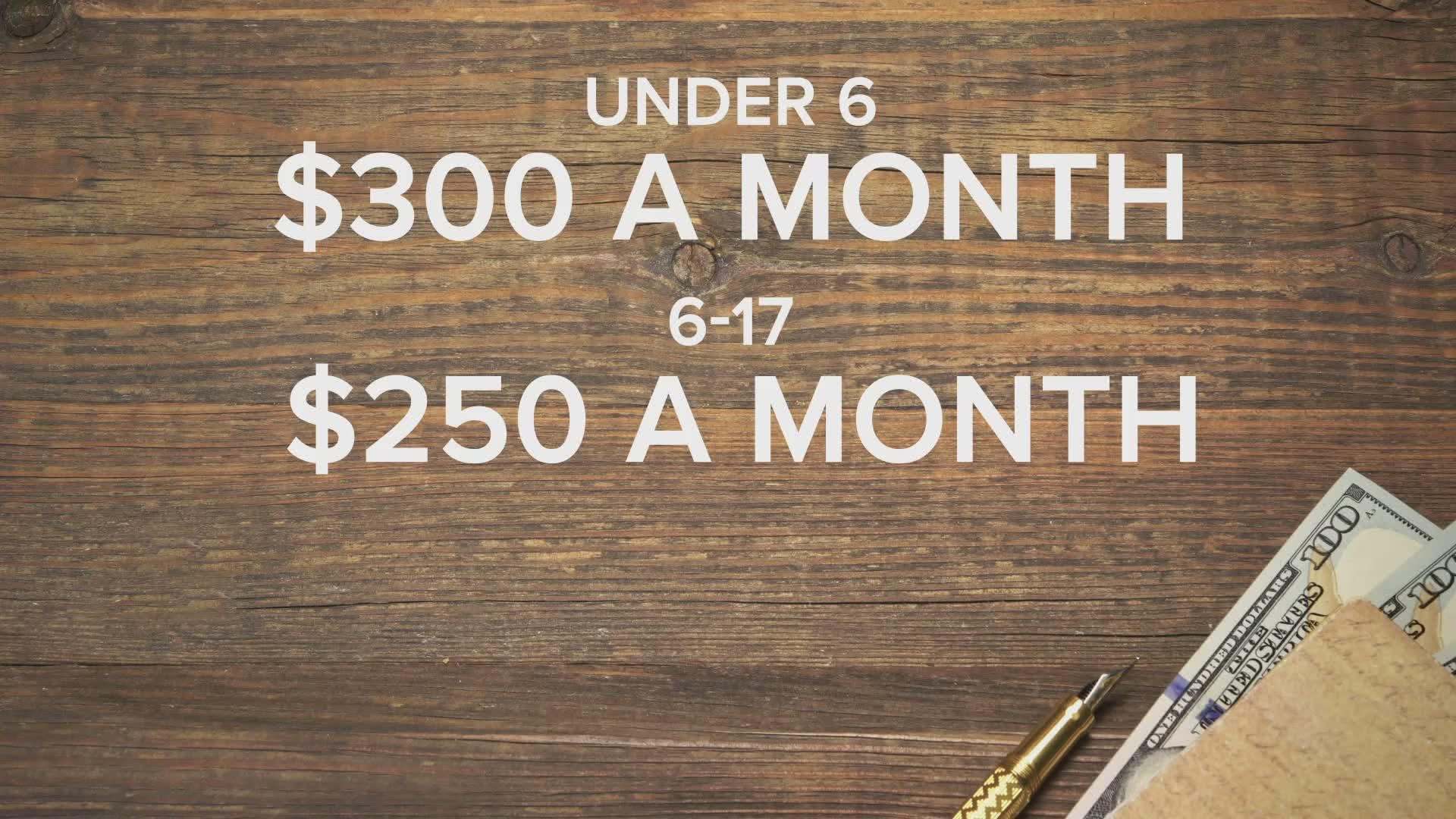

The IRS skipped about 37 billion in advance child tax credit payments for 41 million eligible households but sent more than 11 billion to 15 million filers who didnt qualify. You qualify for the full amount of the 2021 Child Tax Credit for each qualifying child if you meet all eligibility.

Irs Opens Non Filer Portal For Child Tax Credit Registration

Irs Sending Letters To Advance Child Tax Credit Recipients

How To Claim A 3 000 Child Tax Credit File Your Taxes Says Irs Csmonitor Com

How To Opt Out Of Advanced Child Tax Credit Payments And Why Some Accountants Advise It Wbma

Irs 2 New Online Tools Available To Help Manage Child Tax Credit Khou Com

Change Address On Child Tax Credit Update Portal Taxing Subjects

Will You Have To Repay The Advanced Child Tax Credit Payments

Child Tax Credit Worth 3 600 Will Affect The 2021 Return Of Millions The Important Irs Letter You Must Keep Safe The Us Sun

/cloudfront-us-east-1.images.arcpublishing.com/gray/L6QOIUO7NRFJ3ENZ4A52GTLCKU.bmp)

Don T Toss These 2 Important Stimulus And Child Tax Credit Letters From The Irs

Child Tax Credit Irs Mails Letters To Taxpayers About Advanced Payments

/cloudfront-us-east-1.images.arcpublishing.com/gray/OFLFFXUVBFGBHHRPXF3OCRM7PA.jpg)

File Taxes For 2021 To Receive Your Full Child Tax Credit

Irs Adds Address Change Capability To Child Tax Credit Portal Nstp

Irs Child Tax Credit Open To Unenroll And Check Eligibility

Irs Families Receiving Monthly Child Tax Credit Payments Can Now Update Their Direct Deposit Information Money Matters All About Numbers

Are You Missing The September Child Tax Credit Payment Wfmynews2 Com

Child Tax Credit Eligibility Who Gets Irs Payments This Week Wwmt

Third Stimulus And Child Tax Credit Irs Needs Your 2020 Return Abc10 Com

Child Tax Credit Payment Schedule Here S When To Expect Checks 10tv Com

Child Tax Credit Letters From Irs Showing Up In Mailboxes King5 Com